What is the average cost of home insurance?

Table of Content

Their base coverage options include many add-on options that often cost more with other providers. You can also find many available discounts to help lower rates and premiums and make your insurance coverage even more affordable. The more your home is worth to replace, the higher the premiums you can expect to pay to insure it.

This is $348 more than the average auto insurance cost in Georgia and $313 more than the national average, as analyzed by Insure.com. Compare quotes from at least three companies, and be sure you’re looking at equal coverage limits and deductibles. Georgia is susceptible to tornadoes, especially in the northern half of the state, and the peak season occurs in the spring. A standard homeowners insurance policy typically covers damage caused by a tornado.

Atlanta home insurance costs by coverage amounts

After your lawyer negotiates a favorable settlement, you will receive a settlement check from your insurance company. You should receive compensation no more than two weeks after the settlement. If you have to wait longer than two weeks, your insurance attorney will apply pressure on the insurance company to expedite the payment process. An effective strategy to ensure prompt payment of an insurance settlement check involves setting up a direct deposit account. Women are considered to be safer drivers than men, and statistics have proved this, according to the Insurance Information Institute.

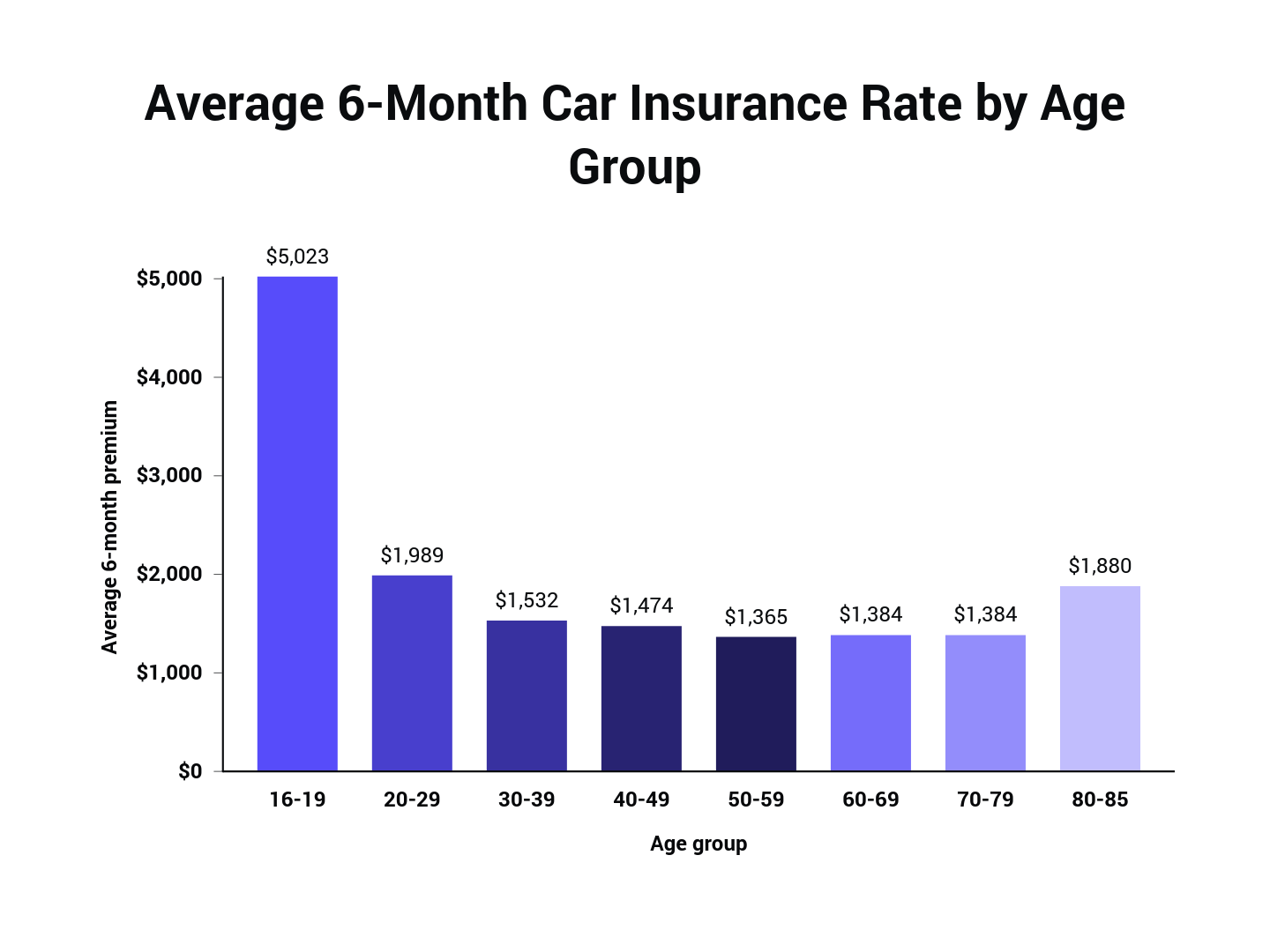

In this guide, we will explain everything from what coverage options are available to which companies have the cheapest rates for homeowners insurance in Atlanta. The car insurance rates for adults and seniors are lower than those for teens and young adults. “This is because they are more likely to obey the speed limits and follow the rules of the road,” says the Insurance Information Institute. If you’re a military member, veteran or family member of someone in the military, USAA may be worth considering. Not only is the average annual rate 10% less than the state average, but the company has a 4.5-star rating from NerdWallet. This is due in part to its strong customer satisfaction, with fewer complaints to state regulators than other home insurance companies of similar size.

How much is homeowners insurance in California?

Liability coverage is another important piece of your home insurance policy. This coverage protects you’re held legally responsible for an accidental injury or property damage. If you have more potential risk, like a dog or a pool, you might consider a higher coverage limit to better protect yourself and your home. Travelers offers a lot of coverage options and benefits for Atlanta residents. Not only do they offer add-ons like water backup coverage, but they also offer coverage for family heirlooms and expensive personal valuables.

This process – known as "bundling" – can cut your costs by up to 19%, on average, according to Insurance.com’s discount data analysis. All policies with initial dwelling coverage used in this study have personal property limits of $200,000. Meanwhile, the policies with dwelling coverage of $2,000,000 have personal property limits of $800,000. Compared to other states, Georgia has a relatively median home insurance cost.

Average car insurance rates by gender in Atlanta

The average cost of home insurance in Georgia tends to be a bit lower than the national average, but there are a lot of factors that an insurance company will examine when quoting you for home insurance. Our team of insurance agents would be happy to help you through the process of getting home insurance quotes that suit your specific insurance needs and home. All you have to do to get home insurance quotes is fill out our quote form or give us a call today. There are a lot of factors insurance providers consider when offering a home insurance policy. Not only will they look at the value and location of your home, but they will also consider personal factors as well. Things like the breed of dog you have or your credit score can negatively impact your home insurance rates.

If your policy includes loss of use coverage, any expenses you might incur from being temporarily displaced from your home because of tornado damage will be covered. Bear in mind that if a tornado is caused by a hurricane or tropical storm, your hurricane deductible may apply. USAA offers replacement cost coverage for personal belongings, which means the company won’t factor in the depreciated cost of your items when you file a claim, but will replace them with new items. If you rent out your home, you can add on home-sharing coverage to protect you and your guests. Enter a dwelling coverage of $200,000, $300,000, $400,000, $500,000 or $600,000. You will see annual average rates based on a $1,000 deductible for each liability limit of $100,000, $300,000.

The Best Cheap Home Insurance in Georgia for 2022

Deductibles usually come in the amounts of $500, $1,000, $1,500, $2,000 and $2,500. At $400,000 in coverage the highest annual average rate is $6,387 in Oklahoma and the lowest annual average rate is $749 in Hawaii. Allows the insurance company to look at the risk factors in that area. Choose the amount you want to pay out-of-pocket before insurance kicks in. The table below outlines some of the average yearly costs for pool owners in the Atlanta area.

Also, teen insurance rates can be lowered by adding teens to a parent’s auto insurance policy. As mentioned earlier, car insurance rates vary from one company to another because the factors used to calculate rates vary by insurer. Therefore, comparing quotes from multiple insurers is recommended to find cheap car insurance rates in Atlanta before deciding on the policy that matches your requirements.

Working with an insurance lawyer helps you navigate what frequently is a complicated claim filing process. Insurance companies emphasize the credit history of applicants for homeowners insurance. It boils down to the risk that an applicant might stop paying premiums or fall considerably behind on sending monthly payments. In addition, homeowners with below-average credit are more likely to file a homeowners insurance claim than homeowners that have never filed a claim. Many factors contribute to the higher than national average cost of homeowners insurance for Atlanta residents. Crime rates for acts such as theft and arson are higher in Atlanta than in smaller cities.

Homeowners with backyard pools present a higher risk for liability claims, so their insurance rates are usually higher. Pet owners, and more specifically dog owners, often have to pay higher home insurance rates depending on their dog’s breeds. Insurance companies have deemed certain dog breeds as aggressive, so they’ll often increase insurance rates on homeowners with a so-called dangerous breed to counteract potential dog bite claims. In general, the higher your liability coverage limits, the more your insurance premiums will be. Even if your home sustained just minor damage, contacting the nearest law enforcement agency can help you win approval for a homeowners insurance claim.

If you want to explore how you can lower your annual premium, visit Credible to compare home insurance companies and costs. The nearer you are to a fire station, the faster emergency services can respond to a fire. That means you’ll have less damage to your home, you may also have lower homeowners insurance premiums. For $300,000 of dwelling coverage with the same limit of liability and the same deductible, the rate would be $1,601, which is 8% below the average for the same coverage.

Comments

Post a Comment